Personal Injury FAQs

Here are some of the commonly asked questions at Meldon Law. If you do not see your question answered, feel free to contact us and we would be glad to answer any question you may have. Remember: This website is not intended to give legal advice for any specific case. Every case is different, and while some of the facts, suggestions, and recommendations that are given may apply to your situation, your case may be the exception to the rule. It is essential to consult an experienced attorney about your particular situation!

Personal Injury

If you are injured in an accident, it may be beneficial to have personal injury protection (PIP). While it is required in some states, in others it isn’t available. Here in the state of Florida, it is a requirement to have PIP, so while many people know that it is part of their insurance plan, many aren’t aware as to what PIP actually covers. Sometimes called “no fault coverage”, PIP provides benefits to you no matter who caused the accident. It covers medical bills and lost wages for you and, under certain circumstances, relatives or other passengers in your vehicle. Standard PIP covers 80% of your medical bills up to $10,000, and this is usually accompanied by a deductible. If you buy extended PIP coverage, the $10,000 limit can change. PIP requires medical providers to reduce charges (normally around 200%) of what can be billed. Another benefit to having PIP is the opportunity to recover lost wages.

Under PIP, you can get up to 60% of your normal pay. However, the most that PIP covers is $10,000 total, so recovering these lost wages can take away from paying for medical bills. Recovering lost wages requires a couple things, the first of which is missing work because of your accident. You will then need to complete a wage verification form and submit it to your auto insurance company. These are the basics of what personal injury protection covers, but if there are any questions, one should always contact a attorney regarding their personal case.

Premises Liability Accidents

As with other types of personal injury cases, an injured person from slip and fall accident in Florida is entitled to be compensated or reimbursed for:

- Out-of-pocket expenses for medical bills, therapy, prescription drugs, etc (present and future)

- Lost wages (present and future)

- Pain and Suffering

- Inconvenience

- Mental anguish

- Loss of ability to work

- Physical impairment, disability and disfigurement

Jeffrey Meldon Tip: Premises Liability cases from tripping or slipping and falling are challenging to prove and litigate. It is important to consult with an Fl experienced accident attorney or law firm who specializes in slip and fall cases to see if you have a case and to do it ASAP to gather accurate evidence before conditions change or witness become difficult to locate.

We at Meldon Law strongly believe that public education is the first step in the prevention of an accident or in the recovery from one.

We are experienced personal injury attorneys, trial attorneys, negotiators, litigators, paralegals, and staff that have been proudly working to get accident victims the justice they deserve for over 50 years in Gainesville, Ocala, Lake City, Inverness, and the rest of North Central Florida and North Florida. Accidents involving a car crash, truck wreck, and motorcycle, bicycle, or pedestrian accidents, dog bites, slip and falls, medical malpractice, and criminal defense are all included in our practice.

Based on Jeffrey Meldon’s, founder of Meldon Law, over 50 years of helping accident victims get justice and a fair shake from the insurance companies, he has written the consumer guide book, Seven Mistakes That Can Wreck Your Florida Accident Case. You can request your free, no obligation copy right now, or contact our office for your complimentary copy sent to you today.

Contact Meldon Law immediately if you have been involved in a serious auto, truck, or motorcycle accident. We are in your community, have the experience and resources required to work towards obtaining a fair settlement for you – we are here to help you.

In any kind of “premises liability” or trip and fall, or slip and fall case in Florida, whether the accident occurred at a shopping mall, business restroom, or walking down the street; the steps to take if you feel you were injured because a business was at fault, for the most part are similar..

Here they are:

- Get medical care right away, or ASAP.

- Document all medical care.

- Take pictures to document evidence of the unsafe condition and of the injury.

- Write down as many of the details and observations about the property and circumstances of your fall.

- Get names of any witnesses.

- Report the incident to the store owner right away.

- Consult with a person injury attorney ASAP if you think you have a serious injury.

- Save other evidence such as the shoes or clothing that you were wearing at the time of the injury.

- Get a copy of any incident report that was written and get it at the time it was written.

Jeffrey Meldon Tip: It is important to document the conditions that caused the injury and to contact a attorney ASAP. This is because an unsafe condition can be remedied or changed after the fact, and it is important to show the conditions as they were on the day the injury occurred. A personal injury attorney (accident attorney) can send out an expert investigator to document and evaluate the dangerous condition and gather evidence.

Jeffrey Meldon Tip: Premises Liability cases from tripping or slipping and falling are challenging to prove and litigate. It is important to consult with an experienced serious injury slip and fall attorney to see if you have a case and to do it ASAP so accurate evidence can be documented before conditions change or witness become difficult to locate.

Jeffrey Meldon Tip: It is common for insurance companies to act quickly and offer a small settlement before the full extent of your injuries become apparent, or before you seek legal representation. It is also common for the owner or the business or their insurance company to deny that the unsafe condition ever existed. Consult with a skilled personal injury attorney before agreeing to any settlement.

Briefly, Premises Liability is a broad legal category of cases which refer to situations when an individual is injured on a property or premise and the owner of the property is held liable for the injury. Slip and Fall, Trip and Fall cases in Florida fall under the category of premises liability.

Jeffrey Meldon Tip: Injuries from slip or trip and fall accidents are common and can be serious and happen in a variety of places and under a variety of circumstances. If you feel you have a premises liability case, consult a personal injury attorney ASAP; doing this will give you the best chance at winning your case.

Jeffrey Meldon Tip: It is important to consult with a experienced slip and fall attorney to find out whether you have a case or not and to also find out if it is worth pursuing legally.

It is possible; however, whether anyone injured by slipping and falling in a retail store can sue or receive a financial settlement from the store depends on the specific facts of the case.

A business has a duty to use reasonable and ordinary care to keep and maintain the property, including the floors, reasonably safe for customers. The business also has a duty to warn customers of a dangerous condition that creates an unreasonable risk of harm, if it is known to the owner and not likely to be discovered by the customer.

In order to prove that the business was responsible for a fall, it must be proven that:

- The danger (water on the floor in this case), was not obvious and visible to the customer.

- There was no way that the customer could have reasonable seen it.

- The owner should have known about the danger or did have actual knowledge of it and failed to clean it up or fix the dangerous condition.

- There was no warning the customer of the danger.

- There was an injury.

- The injury was a direct result of the slip and fall in the business.

Jeffrey Meldon Tip: People have a duty to look where they are walking, and if something is “open and obvious”, an obvious danger, the business may not be liable for injuries caused by it. This is one reason that makes “slip and fall” cases which fall under the category of Premises Liability is difficult to prove by even an experienced Fl slip and fall injury law firm.

Jeffrey Meldon Tip: Storeowners must use reasonable and ordinary care to keep the property reasonably safe for customers. This includes warning customers of non-obvious dangerous conditions known to the owner and to use ordinary care in the active operations of the business and to make reasonable inspections to discover dangerous conditions and make them safe.

States have different laws regarding responsibility for dog bites.

Some states have a rule that a person is not responsible the first time their dog bites someone, since they didn’t have prior knowledge. Florida is different. In Florida, even if it is the first bite, the dog owner is responsible. This concept is called, “strict liability”.

If you are bitten by a dog you can be compensated for:

- Your medical bills,

- Your pain and suffering,

- Any disfigurement or scaring cause by the bite

- Any psychological trauma caused by the attack

Jeffrey Meldon Tip: If you own a dog, make sure you have a homeowner’s policy or renters insurance that covers dog bites. Many homeowner’s policies exclude liability coverage related to dog bites, others will exclude coverage based on the breed.

Jeffrey Meldon Tip: “Don’t hide your dog from your insurance agent. Find out if you are protected and if your dog is a breed that is covered.”

Something to be aware of is: If you or your child are mauled by someone else’s dog, you may never see a penny because your own homeowner’s policy will not cover you for someone else’s negligence; Florida has limits regarding victims’ rights to go after assets of people.

Strict Liability is a legal doctrine referring to absolute legal responsibility for an injury that can be imposed on the “wrongdoer” without proof of carelessness or fault.

As a Gainesville Dog Bite Attorney, what is unique about Strict Liability is that a person does not have to be found careless, or at-fault, or negligent for something that happened that caused harm to another.

In short it means that in certain types of cases, you can be held liable or responsible for something even if you did nothing wrong, there does not need to be proof of negligence when strict liability is applied in the case.

The bottom line is that in most cases there are defenses available to the claim of negligence as in accident or slip and fall cases. However, where there is strict liability, there are no defenses.

Strict Liability is most commonly seen in dog bite cases, and product liability lawsuits for defectively manufactured products.

In dog bites the owner of the dog is responsible or liable even if it was the first bite and the bite was provoked by the bitten person and the dog is restrained in a yard or home.

With defective products, the injured person has to prove that the product caused the injury, but does not have to prove how the manufacturer was careless.

I am local accident attorney Jeffrey Meldon and I strongly believe that public education is the first step in the prevention of and/or recovery from a serious accident. My office and I take pride in our work, and the results we get for our clients.

Meldon Law is a regional law firm that is located in Gainesville, Florida. We are personal injury attorneys, litigators and trial attorneys that have been working to get accident victims the justice they deserve for over 50 years throughout North Florida and all over Florida. Accidents involving a car crash, truck wreck, motorcycle, ATVs, bicycle, pedestrian accidents, and dog bites, slip and falls, medical malpractice, and criminal defense are all included in our practice.

As an attorney specializing in dog bites with over 50 years of experience, I have seen the devastating effects of these attacks. As a dog owner, you may be strictly liable to the victim for damages including: medical costs, and pain and suffering, regardless of whether this was the first attack. Hospital bills alone can easily range in the thousands of dollars, or more, depending on the severity of the injuries.

If your dog severely injures or kills someone, then the dog will likely be confiscated by animal control and possibly be destroyed after an appeal period of 10 days passes. If the dog was previously declared dangerous by authorities, and it attacked or killed someone, then the owner could face misdemeanor or felony criminal charges. If the authorities receive a first time report of an attack, then animal control might impound a dog and require the owner to register their dog as a dangerous animal.

Yes, as an experienced personal injury attorney, dedicated to helping people recover damages in civil suits, it is important to know that a dog attack may result in misdemeanor or felony criminal charges. Criminal charges are more likely when a dog was previously declared dangerous by the authorities and it attacks someone or if the dog seriously injures or kills someone and the owner had prior knowledge of the dog’s dangerous traits.

An owner is not just liable for attacks on people but also animals in Ocala and the rest of Florida. The law states that a dog owner may be liable for damages resulting from an attack on “domestic animals” or “livestock” such as a horse, cow, goat, ostrich, dog, cat, chicken or other bird.

Yes. This is sad but true and sometimes necessary to protect the public welfare. The law states that a dog might be confiscated, quarantined for 10 days to allow for the owner to file an appeal, and then put to death in a humane way, if the dog caused severe injury or death, even if it was the first attack.

The Attractive Nuisance Doctrine protects a child who wanders or trespasses onto another’s property and is injured by a dangerous condition. Attractive nuisance is a negligence action, based on a land owner’s premise liability and to protect children from unreasonable risk of harm.

Generally, a land owner may be responsible for a child trespasser’s injuries if:

- The property owner knows or has reason to know that the place where a dangerous condition exists is one where a child may trespass;

- The dangerous condition is known to or should be known to cause unreasonable risk of harm to a child;

- The child, because of their young age, does not realize the risk involved with the dangerous condition;

- The burden of eliminating the danger is less than the risk posed to a child; and

- The property owner fails to act with reasonable care to remove the danger or protect the child from the risk of danger.

Additionally, the dangerous condition must be one that is man-made, like a pool or hot tub, and constitutes an attractive “trap” for a child. Land owners near a playground, residential area, school, or other populated area where children frequent may have a greater duty to eliminate dangers. It’s important to know that a natural body of water, like a lake, stream, or pond may not be an attractive nuisance, so make sure to protect children.

One argument that a landlord may use to try to escape liability following a Florida dog bite is to claim that you entered the property without permission. If this is the case, it is vital that you seek the guidance of an experienced Gainesville dog bite attorney. Your attorney can help to assess the facts and circumstances surrounding the bite to determine whether you are entitled to compensation for your injuries. Some of the factors that the attorney will consider include:

- Did the landlord give the tenant permission to keep the dog on the premises?

- Was there language in the lease agreement relating to dogs?

- Did the landlord know that the dog was dangerous?

- Did the landlord take reasonable measures to prevent dog bite injuries?

- Where on the property did the dog bite occur?

- Were you invited to come onto the property?

- What was your purpose for being on the property?

- Did you exceed your invitation by entering an area of the property where you were not supposed to or expected to go?

Often, the answer as to whether or not the landlord is liable may not be clear. In order to protect your legal rights, an experienced and knowledgeable legal professional should be brought in to look out for your best interests. To learn more about whether you have a claim for damages against a landlord following an injury, contact an experienced Gainesville dog bite attorney today. Call Jeffrey Meldon & Associates at our toll free number, 800-373-8000, for a free consultation.

We at Meldon Law strongly believe that public education is the first step in the prevention of an accident or in the recovery from one.

We are experienced personal injury attorneys, trial attorneys, negotiators, litigators, paralegals, and staff that have been proudly working to get accident victims the justice they deserve for over 50 years in Gainesville, Ocala, Lake City, Inverness, and the rest of North Central Florida and North Florida. Accidents involving a car crash, truck wreck, and motorcycle, bicycle, or pedestrian accidents, dog bites, slip and falls, medical malpractice, and criminal defense are all included in our practice.

Based on Jeffrey Meldon’s, founder of Meldon Law, over 50 years of helping accident victims get justice and a fair shake from the insurance companies, he has written the consumer guide book, Seven Mistakes That Can Wreck Your Florida Accident Case. You can request your free, no obligation copy right now, or contact our office for your complimentary copy sent to you today.

Florida is a state that imposes strict liability on the owners of dogs for dog bite cases. This means that in general, when a dog attacks a human being, the dog owner is liable. This is true regardless if the owner had reason to believe the dog was potentially dangerous. There are certain exceptions, however, to this general rule. One such exception is the so-called “Bad Dog” exception. Under this provision, if a dog owner posts an obvious and readable sign warning of the dangers of the dog, the owner may not be liable.

Since recovery for your medical expenses and pain and suffering is dependent upon the dog owner’s liability for the Gainesville dog attack, it is vital that you consult with an experienced attorney. A skilled attorney will analyze the following questions to determine whether the dog owner may be liable for your injuries:

- Was the victim age six or older?

- Did the Florida dog bite attack happen at the dog owner’s premises?

- Was a “Bad Dog” or “Beware of Dog” sign prominently posted?

- Was the sign easy to read?

- Was the victim able to read the sign?

Bicycle Accidents Information & Safety

Yes. As a Gainesville bike accident attorney, I know that a bicyclist is required by law to either carry a bell with them or equip their bike with a bell.

A bell should be sounded when overtaking a pedestrian on a roadway or sidewalk. It is also intended to alert a pedestrian of a, likely, fast moving vehicle approaching to avoid creating an accident.

For more information:

This is a good question. The general rule is that Florida law permits bicyclists to ride on the sidewalk. However, a city, county, or municipality may pass additional rules restricting bicyclists from sidewalks. The City of Gainesville allows people to ride on sidewalks unless specifically prohibited. Check with your area’s code of ordinances.

In answering this question as an accident attorney, safety is key. The National Highway Traffic Safety Association (NHTSA) generally recommends that people 11 years of age and older ride on the street or roadway because it is safer. Motor vehicles may be more aware of bicyclists when they are travelling with the flow of motor vehicle traffic and obeying the same traffic signals.

Florida law only requires persons under the age of 16 to wear a helmet when riding a bicycle.

However, as an accident injury attorney that has represented many seriously injured bikers in Ocala, Gainesville and all of Central Florida, I recommend that everyone wear a helmet to protect themselves from traumatic brain injury, serious injury, or even death.

The best way to get in the habit of wearing a helmet is to find one that gets you excited-fashionable, comfortable, and safe.

As a personal injury attorney and long time resident of Gainesville, I am proud to tell you that if you live in North Central Florida, you can contact Safe Kids of North Central Florida to see if they are giving out free helmets.

Since June 2004, Safe Kids has given out approximately 3,000 helmets to children. Contact Safe Kids at (352) 231-4636 or online @ shandssafekides.org.

Remember, a helmet does not have to be expensive to give your child’s head adequate protection in the event of an accident.

As an accident attorney, I would like to give you a word of caution when buying used bicycle helmets because sometimes damage is nearly impossible to detect to the lay eye because the foam can be impacted underneath the hard shell.

I understand that children grow quickly and budgets can be tight, however, if you buy a used helmet, for your child or yourself, make sure it hasn’t been in any accidents and inspect it for any signs of damage. If it has been in a fall or a collision, then the internal foam may be impacted, and it will no longer safely protect your or your child’s head from brain injury.

Also, if you buy a used helmet in a retail store, it should have an ASTM, Snell, or ANSI certification. Look for a sticker inside the helmet.

Remember, a person should not have to sacrifice safety for themselves or their child if they decide to buy a new bicycle helmet at discount prices. According to the Bicycle Helmet Safety Institute, a $10 helmet will offer the same impact protection as a $200 model – as long as the helmet carries the U.S. Consumer Product Safety Commission (CPSC) sticker.

This is an important question and the answer is, when buying a new helmet, look for the U.S. Consumer Product Safety Commission (CPSC) certification. There should be a sticker inside the helmet showing that it meets national and state safety standards. These stickers are on all approved, adult and children’s, helmets.

Big Truck Accidents

This is one of the reasons that big truck accidents are more complex and complicated. There can be a variety of people and companies that can be held liable in the event of an accident when someone is hurt in a truck wreck. Whether it is your local delivery pick up truck or the semi 18 wheeler going down the interstate, there is more than just the driver to be held responsible.

In most truck accident cases there can be many responsible parties such as:

|

|

Anytime a large truck accident in Florida occurs, there is a substantial risk of significant injury to drivers, passengers, and other motorists. Rollover accidents are no exception. The size, shape, and weight of a semi-truck make these vehicles more susceptible to rolling over. When they do rollover, their size and weight increase the odds and severity of injuries. Unfavorable road conditions can raise the likelihood of these accidents occurring. Fortunately, a knowledgeable Florida truck accident attorney can help you receive the compensation that you deserve if you are unfortunate enough to be involved in such an accident.

Road conditions that increase the odds of big truck rollover in Florida include:

|

|

If the Florida rollover accident that caused your injuries was related to roadway conditions, you may potentially have additional responsible parties beyond the driver of the truck. Unfortunately, many victims make mistakes following an accident that drastically impact the size of their compensation. Obtaining the maximum compensation is important because you may be facing continuous and ongoing medical treatment, rehabilitation, and loss of income.

Boating And Pool Accidents Safety And Information

As the state with the highest rate of unintentional toddler drowning deaths in the U.S. from 1999 to 2003, Floridians cannot be too careful about pool safety.

In the U.S., drowning is the second leading cause of child death, second to motor vehicle accidents. Statistically, 50% of children submerged in a pool, die.

As a personal injury attorney in Gainesville and all of North Central Florida, I urge the following pool safety steps:

- Fence, Cover, or Alarms. Equip your pool, old or new, with a statutorily compliant safety device, such as a 4-foot barrier or fence, a safety cover, house alarms. See the Residential Swimming Pool Safety Act F.S. §§ 515.21-.37(2011) for specifications.

- Door Alarms. If your house is a barrier around a pool, make sure the windows and doors have sensors and alarms.

- Supervision. Always keep your eyes on children or medically frail seniors when a pool is present-even if no one is swimming.

- Arm’s reach. When swimming, practice “touch supervision.” Keep your child at arm’s length.

- If you’re considering installing a pool, wait until your child is at least 5 years old.

- Visibility. Maintain water in clear condition and remove toys from the pool when not in use (also avoids attracting children). An automated pool cleaner or fun-shaped thermometer (rubber duck) may attract kids too.

- Teach your child to swim when age appropriate;

- Keep rescue equipment (life preserver, shepherd’s hook, and phone) near the pool.

- When a child is missing, look in the pool first.

- Learn CPR and how to swim.

- Drain covers. Avoid entrapment by maintain pool and spa drain covers in good working order.

- “Floaties.” Do not rely on air-filled flotation devices to supervise your child for you.

- Prohibit running, diving, or riding toys near the pool.

Drowning may occur in a matter of minutes and can result in death or serious lifelong injury.

Car And Motorcycle Accidents

Under Florida law, the insurance company has the right to hire their own doctor to determine whether or not they should continue to pay for your medical bills under your own personal injury protection (PIP) policy. The insurance companies have certain doctors who are “hired guns” and for 99% of people they examine, these insurance hired doctors determine that little or no future medical treatment is necessary. The insurance company will then write you a letter saying that your future benefits are terminated. In many cases, the insurance company does this even when your own treating medical doctor determines that you do need future medical treatment.

Jeffrey Meldon Tip: Hire a Florida car accident attorney who is experienced at fighting the Florida insurance company PIP scams! There are tactics that can be used in these so called “independent medical evaluations”.

My Office and Associates are located in Gainesville, Florida. We are Personal Injury Attorneys (Accident Attorneys). I take pride in my work and the results that I and my experienced team of Associates and Staff get for our clients.

Everyone in my Office works hard to help accident victims get the justice and the fair settlement or jury verdict that they deserve throughout the North and Central Florida area including: Ocala, Marion County, Alachua County, Lake City, Citrus County, Daytona Beach, and Inverness. I am highly involved with every case in my office and am the negotiator with insurance companies.

You can feel free to give me a call or contact my office, with any questions you may have, or to discuss your unique case.

Consultations and Case Evaluations are always Free.

It is common for the insurance adjuster to call after an accident, and to even ask for a recoded statement regarding your injuries, they can seem very nice and concerned for you, however, Jeffrey Meldon Tip: The day you were injured you entered a war zone – and the insurance company is NOT on your side of the battle NOR are you on an even playing field with them!

Here is why:

Insurance claims adjusters receive extensive training in how to save their company money and not necessarily in how to examine a claim and pay a fair settlement. They do this every day and all day. It is their job! It is the way they feed their families and pay for their homes. In short, they are the professional in this field and you are not. It has nothing to do with how smart or successful you are in other areas of you life. Insurance adjusters have the advantage because they settle claims for a living. In fact, many insurance companies reward their adjusters with bonuses or promotions based on how much money that person saves the company rather than how may claims they settle. They are not bad people; they are just doing their job.

This is one of the most frequently asked questions and the answer varies with each and every case and with the expertise and experience of the personal injury attorney working on an injury case and how skilled they are in navigating the accident insurance world, negotiating and litigating. (Experience makes the difference!)

Basically, your case is worth either what you agree with the insurance company it is worth or the amount of cash award awarded to you by a court of law.

There are many variables that go into answering this most important question. Here are a few:

- How much insurance is available? (For example, if a personal injury case is worth $100,000 but there is only $10,000 available in insurance coverage, then the case is more than likely worth only $10,000, because that is probably all they will get out of it).

Jeffrey Meldon Tip: Make sure you are protected with adequate insurance coverage including Uninsured Motorist Coverage!

- How serious are the injuries? (For example, if there is $250,000 worth of insurance coverage, but the injuries are minor, the case will be worth much less than the $250,000). Check out this Library Article for more information on this.

- How much damage was done to the vehicle?

- How much are the person’s medical bills and projected future medical bills?

- How much income was lost because of the accident and future loss of income?

- Were there any prior or preexisting medical conditions?

- Who was at fault in the accident? (Florida is a comparative fault state, if there is more than one person at fault for the crash the value of the case will be affected.)

Jeffrey Meldon Tip: Unless you are in the business of evaluating and settling cases for a living you should look to an experienced personal injury attorney for guidance.

Jeffrey Meldon Tip: If you have what may be a serious injury, it is important to get legal advice early on to avoid making a mistake that could wreck your case.

Jeffrey Meldon Tip: Beware, there are many strategies employed by insurance companies to settle cases for less than full value! Don’t become a victim a second time.

Seven Mistakes That Can Wreck Your Florida Accident Case, written by Attorney, Jeffrey Meldon, is a consumer guide book for accident cases in Florida. Whether you have been in an accident or not, this book contains valuable information for you! To get your free copy, contact us and request that it be sent to you free of charge or you can request it immediately online. All free of charge and with no obligation.

This is an excellent question as there are several very important Do’s and Don’ts that you should follow immediately after a car or truck accident and in the weeks following an accident.

Immediately after an accident:

Do These Things:

- Report the accident immediately to the nearest police department (call 911). The police will conduct an initial investigation that should include basic accident reconstruction and the interviewing of witnesses.

- Record the names and address of all witnesses to the accident (before they leave the scene) and take pictures of the accident scene. It is important to keep a disposable camera, notepad and pencil in your glove compartment

- Wait for the Emergency Medical Service (paramedics) to arrive on the scene so they can examine you.

- Go to the hospital or doctor immediately.

- Notify your insurance company.

Jeffrey Meldon Tip: A delay in getting medical treatment can hurt your case as well as create the risk of making your injuries worse. Be honest about your injuries, nothing will damage your claim faster than being caught in a lie.

Do Not Do These Things:

- Talk with the other person’s insurance company until you have consulted with an attorney.

- Sign any insurance company documents, papers, or medial authorizations without speaking with an attorney. (To find out more about tactics Insurance Adjusters often use, I suggest you read this Library article.)

Within the next few weeks after an accident

Do These Things:

- Seek follow up medical care with a doctor who has experience in treating accident injuries. Be honest with your doctor about all your prior injuries and accidents.

- Educate yourself, do your homework, on how to select the best attorney for your case, one who can effectively represent you.

- Consult an experienced personal injury attorney about your case, if you are injured.

Jeffrey Meldon Tip: Be honest with your attorney, your attorney needs to know the good, the bad, and the ugly about your case to properly represent you!

- After consulting with your attorney, submit the forms necessary to get your medical bills and lost wages paid. Your attorney will help you with this.

- Refer insurance company calls to your attorney.

- Take notes before your doctor’s appointment so you can be sure your doctor accurately documents your progress in your medical records.

Jeffrey Meldon Tip: You may want to write it down before hand and give it to your doctor at your office visit.

Jeffrey Meldon Tip: If the information is not in your medical chart, it is difficult to prove your injury.

- Follow your doctor’s advice regarding your treatment.

- Make sure your doctor knows if your injuries are affecting your ability to work.

- Keep track of all the medical treatments, visits, and procedures you received after your injury, make a file with dates.

Do Not Do These Things!

- Exaggerate or minimize the extent of your injuries or symptoms to your doctor.

- Hide information from your attorney.

Jeffrey Meldon Tip: Your Florida car accident attorney needs to know the good, the bad, and the ugly about your case to properly and successfully represent you!

- Sign anything without consulting your attorney.

- Talk with your doctor about your lawsuit or your attorney’s advice.

- Stop your medical treatment too soon.

People are often confused about what PIP is, whose insurance company pays out the benefits in the event of an accident, and what is meant by Florida being a “no-fault” State. As a local personal injury attorney, here are the facts:

- PIP stands for Personal Injury Protection and under Florida law it is required that every vehicle owner and driver on the road have $10,000 worth of PIP insurance coverage.

- PIP benefits are paid by your own insurance company if you are in an accident.

- PIP benefits are paid by your own insurance company regardless of who was at fault for the accident. This is what is meant by Florida being a no-fault insurance State.

- PIP insurance pays for 80% of your medical bills and 60% of your lost wages, up to $10,000. This means, you have to recover the rest of your out of pocket expenses from the driver that caused the accident.

- PIP covers any accident or injury that involves a vehicle, even if you are on a bicycle or a pedestrian and are injured by a vehicle.

Beware: Even if you are completely innocent in an accident, you can get stuck with thousands, or even hundreds of thousands, of dollars of medical bills, loss of income, and a permanent injury. All of which can be devastating. Make sure you are adequately protected!

Because of this, Gainesville and Ocala car accident attorney Jeffrey Meldon wrote the book Buying Florida Auto Insurance – A 3 Step Approach to Purchasing Adequate Auto Insurance at Competitive Pricing.

Insurance is a topic that I feel extremely passionate about based on my 37 years of doing all I can to fight for justice for the injured as an accident attorney! Please read about my full insurance tips and recommendations in this Library Article.

Beware, even if you are completely innocent in an accident, not at fault, you can still get stuck with thousands or even hundreds of thousands worth of medical bills, loss of income, and a permanent injury that can devastate your life!

Uninsured/Underinsured Motorist Coverage (UM) will protect you if the at-fault party in an accident has little or no liability insurance and your case is worth more than the amount of insurance the other person has. For example: If you have $100,000 of medical bills and lost wages, and the person that caused the accident has no insurance other than the minimum required insurance ($10,000 to pay for the other person’s car damage and $10,000 PIP to cover their own medical bills and lost wages), or even none at all. Over 50% of drivers on the road in Florida have little, only the legally required minimal insurance or non at all! Then you may have to come up with $90,000 out of your own pocket to cover your medical bills and lost wages, unless you have PIP plus $90,000 of UM insurance coverage.

Florida repealed the universal helmet law in 2000 for riders over the age of 21. So if you are over 21 years of age, you do not have to wear a helmet legally while riding a motorcycle or motor scooter. However, if you choose not to wear a helmet, you are legally required to carry $10,000 of Medical Payment Insurance.

The State of Florida only requires a driver and vehicle owner to have $10,000 of PIP insurance which covers part of their medical bills and lost wages and $10,000 worth of Property Damage to pay for the other person’s car repairs, if they were at fault for the accident.

It is easy to see the problem, especially when the $10,000 of PIP can often be used up by the time someone leaves the emergency room.

The short answer is, yes. Many people do not realize that the owner of the at-fault vehicle is first in line and the primary party responsible for legal liability issues regarding damages and injuries caused in an accident; the driver of the vehicle is second.

Jeffrey Meldon Tip: Sometimes it is hard to tell a good friend that you would rather not let them borrow your car, but remember if something happens, you will be on the hook. It is a good idea to let them know if they want to borrow your car, and you are willing to let them, to remind them to be extra careful because you will be responsible if they make a mistake.

Also, if there is an accident caused by a vehicle you lent out and the injured person’s case exceeds your insurance policy limits, you could lose everything you own (other than your homestead).

As an example, recently we represented a woman injured in an Ocala personal injury auto accident case that was not her fault. In this case the person that was primarily responsible for the crash was not even in his car at the time of the accident. He was comfortably at home on his couch watching a football game. He was the owner of the at-fault vehicle and had lent his car to a friend to run up to the corner store. Now he was facing legal claims against him by the injured woman. The woman, our client, was able to collect against the car owner for the full amount of his insurance policy which was the value of the woman’s injuries and the driver of the vehicle that actually caused the accident ended up having to pay nothing. Not only did his insurance company have to pay for injuries suffered in the accident, his insurance rates will end up increasing.

What Does a Personal Injury Attorney Do and What Should I Look for in a Personal Injury Attorney?

Here is an explanation: When you are injured because someone else was careless or negligent, you may have a personal injury case. A personal injury case can result from: a car, truck, motorcycle, bicycle, scooter, pedestrian accident, or if a person or business causes someone to be injured because a dangerous condition existed at their store or on their property.

Basically, a personal injury case or claim is just what it sounds like, an injury that occurs to your person (body), mind, or emotions, and not your property, due to someone else’s carelessness. For example, if you are in a store and a large box falls off a rack onto you causing you to break your leg and also break your watch, then you may have a personal injury claim against the store owner for your physical damage (the broken leg), but not for the damage to your watch; that would be a property damage claim against the store owner.

A personal injury from a car or truck accident is any type of claim where a person has been injured due to someone else’s carelessness. As with the watch in the above example, if only your car or truck was damaged, then you don’t have a personal injury case – however, you may have a property damage case. If both you and your vehicle have suffered injuries, then you have two claims, personal injury and property damage.

The law has a special name for someone whose carelessness causes injury or death, it is called being “negligent”. People, corporations, and governmental groups can all be held responsible for their actions or negligence.

When the accident was the fault of someone else, then the injured party may be entitled to monetary compensation (money), from the person who was careless. Before you are awarded any recovery for your injury, it must be proven that the careless person or business that caused the accident was actually negligent. This is called proving liability or responsibility. This is what personal injury attorneys do.

There are legal consequences of not wearing a seat belt that should be taken into consideration in addition to the safety factor. One of them is called the seat belt defense. In Florida, insurance companies can claim a seat belt defense if the injured person was not wearing a seat belt at the time of the accident.

As an example, let’s say you were sitting at a stop light waiting for the light to turn green, not wearing your seat belt, and you were rear-ended with enough impact force that your head went through the windshield, causing severe facial, head and neck injuries. The insurance company of the driver at fault for the accident can argue that your head would not have gone through the windshield if you were wearing your seat belt, and in fact you may not have even been injured at all.

A jury will hear the evidence and the law and determine what percentage of the injuries was caused because you failed to wear your seat belt as required by law in Florida. If the jury finds you to be 60% responsible for your injuries under comparative negligence, you would only receive 40% of your just compensation from the at fault driver.

As an experienced accident attorney, I recommend that you: be safe, protect yourself, obey the law, and buckle up!

This is a commonly seen situation after someone has been in a bad accident, and an important topic to bring up with your doctor and accident attorney right away. It can be a real thing and should not be ignored; there is help.

According to the American Psychological Association, over 3 million people are seriously injured in car accidents each year. It is reported that up to 45% of those people will suffer from Post-Traumatic Stress Disorder or PTSD. I encourage you to read my article on PTSD to find out more about this topic and why it is so important to report these feelings.

We at Meldon Law strongly believe that public education is the first step in the prevention of an accident or in the recovery from one.

We are experienced personal injury attorneys, trial attorneys, negotiators, litigators, paralegals, and staff that have been proudly working to get accident victims the justice they deserve for over 50 years in Gainesville, Ocala, Lake City, Inverness, and the rest of North Central Florida and North Florida. Accidents involving a car crash, truck wreck, and motorcycle, bicycle, or pedestrian accidents, dog bites, slip and falls, medical malpractice, and criminal defense are all included in our practice.

Based on Jeffrey Meldon’s, founder of Meldon Law, over 50 years of helping accident victims get justice and a fair shake from the insurance companies, he has written the consumer guide book, Seven Mistakes That Can Wreck Your Florida Accident Case. You can request your free, no obligation copy right now, or contact our office for your complimentary copy sent to you today.

Facts are: the use of seat belts and child safety restraints greatly reduces the chances of serious injuries or even death in vehicle crashes. Additionally, on average, a victim of the traffic crash who did not wear a seat belt will incur inpatient hospital costs which are 50% higher than those for a victim who was wearing a seat belt. However, there are still certain myths that surround seat belt uses.

“I don’t need to wear a seat belt if I am driving short distances.”

Buckle up even if you are making a quick run to a store or a friend’s house across the road, since 80% of traffic fatalities occur within 25 miles of the victim’s home. In addition, three out of four fatal vehicular accidents occur at speeds less than 40 miles per hour. Remember that even if you are good driver who have never been in an accident, you might be hit by someone who is not!

“If I wear a seat belt, I will not be able to get out of a burning or sinking car.”

The possibility of fire or submersion under water in a traffic accident is very low: only one out of 200 traffic accidents that cause injuries entail a car catching on fire or being submerged under water. By wearing a seat belt, you are not only reducing a risk of hitting your head or smashing your chest into a wheel, preventing a serious injury, but you are also reducing a risk of being knocked unconscious and not being able to get out of the vehicle at all.

“If I get in an accident and I don’t wear a seat belt, I will be thrown out of the car and actually reduce my chances of dying.”

The chances of being killed in a car accident when you are thrown out of the car are 25 times greater than if you remain in the car. The force with which you may be thrown from the car can be so strong that you may land as far as 150 feet from your vehicle. The chances of surviving a landing like that are grim. Seat belt will keep you inside the car, reducing your chances of being thrown out of the vehicle, suffering serious injuries or even dying.

Remember: Seat belts may save your life. Buckle up, and make sure to remind others to do the same. Here are 10 other reasons to buckle up.

According to Florida law, Florida Statutes Section 316.123, when approaching a yield sign, you should first slow down and possibly stop in order to see what the other cars are doing. The cars already in the intersection or highway have the right-of-way and you should yield to them, not the other way around.

If you are injured by a driver who does not stop at a yield sign, the law clearly states that the fact that you were injured acts as evidence of the driver’s fault in the accident. Please seek the help of an experienced accident attorney for more information.

According to Florida law, Florida Statutes Section 316.123, when you are approaching a four way stop, the first person to come to a complete stop is given the right to pull through the intersection. If more than one person stops at the same time, the person to the right has the right-of-way and may proceed through the intersection. This is the rule for all of Florida, including Gainesville.

However, as an experienced accident attorney, I caution you to make sure you are aware of what the other drivers are doing. Make sure they see you and know you are entering the intersection before them. When in doubt, stop, wait, and be safe.

There are a variety of different measures that you can take to ensure that you first understand your policy and second that you are prepared for what happens when you have to make a claim with your insurance company, especially if your insurance company denies your policy in Gainesville or throughout Florida.

- Know What Your Policy Says: Read your policy! You should always know what your rights are under the specific language of your policy. Sometimes policies can be difficult to understand. In that case, contact an experienced attorney in your area to help you understand exactly what your policy means.

- Fill Out the Forms Carefully: Sometimes making a mistake while filling out forms can give your insurance company to deny your claim later down the road, even if it is a simple, innocent mistake. Take the time to make sure you are filling in the correct information and are consistent throughout all of your forms.

- Contact Your Insurance Company for Help: Sometimes the best resource for questions is your insurance company itself. However, for personal questions, you probably will need to find and consult with an experienced accident attorney in Gainesville because your insurance company will usually not be able to help you.

- For Information on Bad Faith Denial of claims, here is a link to our Library article on this topic.

This is a good question and one that I am often asked as an experienced Gainesville personal injury attorney, specializing in motor vehicle accidents that often involve trucks. Yes. According to Florida law, it is legal to ride in a tuck’s cargo area, if you are 18 years of age or older in any county in Florida.

I am local accident attorney Jeffrey Meldon and I strongly believe that public education is the first step in the prevention of and/or recovery from a serious accident. My office and I take pride in our work, and the results we get for our clients.

Meldon Law is a regional law firm that is located in Gainesville, Florida. We are personal injury attorneys, litigators and trial attorneys that have been working to get accident victims the justice they deserve for over 50 years throughout North Florida and all over Florida. Accidents involving a car crash, truck wreck, motorcycle, ATVs, bicycle, pedestrian accidents, and dog bites, slip and falls, medical malpractice, and criminal defense are all included in our practice.

Probably yes, because in Florida there is a presumption that a driver who rear-ended another vehicle was the sole cause of the crash.

This means, if it is shown that the accident was due solely to the other driver’s negligence when he rear-ending you (and you were simply waiting at a stop light and did not contribute to the accident in any way), then the other driver is responsible for 100% of your damages.

This is an important question because in Florida it is required to wear an approved protective helmet when riding a motorcycle, unless the biker is over 21 and carries $10,000 of medical payments insurance.

Here is what the Statute says: “A person may not operate or ride upon a motorcycle unless the person is properly wearing protective headgear securely fastened upon his or her head which complies with Federal Motorcycle Vehicle Safety Standard 218…” The exception to this law is if a biker is over 21 and carries $10,000 of medical payments insurance.

It is important to purchase a motorcycle helmet that meets with Standard 218 criteria not only because it is the law but also because, Standard 218, “establishes minimum performance requirements for helmets designed for use by motorcyclists and other motor vehicle users. The purpose of this standard is to reduce deaths and injuries to motorcyclists and other motor vehicle users resulting from head impacts”.

Helmets that do not meet the minimal Department of Transportation (DOT) certification standards may not be sold as “motorcycle helmets.”

In other words, motorcycle helmets must have a DOT sticker on them, which means that before they could be sold as a helmet for motorcycles, a model had to have been submitted for testing to see if it met the DOT standards.

Also, when choosing a helmet make sure that it not only has the DOT sticker on it, but that it is the proper size for your head, here is a link to a motorcycle helmet size chart.

Reminder: Proper fitting motorcycle helmets protect your head and your rider’s head, they are important to wear every time you get on your bike, even if just for a short spin, because no matter how good a driver you are, other drivers can make a “bonehead” move and your life can change forever.

As an accident attorney for the Gainesville and Ocala area and it’s surrounding rural communities, I can say that this is a very important question and topic, as head-on collisions are very serious and can often cause fatalities and serious injury. In addition, head-on crashes occur more commonly on rural roads.

Most of the basic prevention suggestions listed below apply equally to a driver wanting to avoid causing a head-on crash and also to the driver wanting to avoid being a victim of another person’s mistake. Here are some of the main things that you can do to prevent being in a head-on crash:

- Pay attention to the road and do not drive distracted with cell phones or other driver distractions

- Do not drive under the influence

- Pay extra attention in construction zones

- Wear necessary prescription eye glasses

- Do not drive when emotionally upset, fatigued or tired

- Obey directional road signs

- Obey the speed limits

- Know when and where is the proper time and place to pass another vehicle on a 2 lane road; know the rules for passing another vehicle.

- Keep your vehicle properly maintained at all times including proper care of your tires

Florida law is very clear about this, and violation of failing to use turning signals properly can result in a traffic ticket. Below is a summary of the laws, for more information see, Turning Signals; Know the Law for Safe Driving.

As an accident attorney I know how important it is for a driver to follow these steps when making a turn to be safe, legal and to avoid causing accidents in Florida:

- Signal before putting on the brakes to let other drivers and pedestrians know what you are going to do on the road before you do it.

- Have the turning signal turned on continuously for no less than 100 feet before the turn.

- Make a turn only if it can be done with reasonable safety. This means that when you have even the slightest doubt about whether you should make a turn because of other oncoming vehicles, you should NOT turn. Instead, if there are no vehicles behind you, you should wait until the oncoming vehicle passes and only then turn. If there are other cars behind you, you should turn the turning signal off, continue on driving until you can turn around, have a turning signal turned on continuously for 100 feet before a turn and finally make a turn.

- I am local accident attorney Jeffrey Meldon and I strongly believe that public education is the first step in the prevention of and/or recovery from a serious accident. My office and I take pride in our work, and the results we get for our clients.

As a personal injury attorney throughout the state of Florida, Jeffrey Meldon says, yes, you can get a ticket for jay-walking even if no cars are around no matter where you are in the state. Here is the info:

- A pedestrian can receive a ticket for violations of the above-mentioned laws in the amount of $15. Florida law requires that a pedestrian cross the road only on a marked crosswalk if it is provided.

- Pedestrians must also obey the pedestrian lights and cross only on green, regardless whether there is traffic on the road or not. While you might think that the road is clear to cross, a driver may be speeding and will get to where you are faster than you might think. Similarly, while your street may be clear of traffic, a vehicle may suddenly make a turn onto your street.

- By following the above-mentioned rules you will not only avoid a ticket and a penalty for improperly crossing the road, but you will also keep yourself safer on the street.

Here is more information on the rules and laws regulating pedestrians in Florida.

Be safe walking on or near the road; pedestrian accidents are one of the most fatal types of accidents and can cause serious injury.

As an accident attorney, that has seen the devastating effects of school bus accidents involving a child hit by a car, I can say that this is an important topic to be reminded of as school is starting. Below I have given the penalties, however, keep in mind the biggest penalty is not the price of the ticket for failing to stop for a school bus but the potential heart-breaking consequences if you should injure or kill a child or children because you failed to stop or were distracted by a cell phone or some other driving distraction and failed to stop. According to Florida Statute §318.18(5):

- The penalty for failure to stop for a school bus is $100, and for a second offense within a period of 5 years the driver will have his/her driver’s license suspended for a minimum of 90 days and up to 6 months.

- Penalty for failing to stop and passing a school bus on the side where children enter and exit is $200 with a driver’s license suspension of 180 days to a year for a second offense within a period of five years.

- In each case, a penalty of $65 is imposed in addition to the above amounts in to be remitted to the Administrative Trust Fund of the Department of Health.

As an accident attorney I can tell you that this is a good question to ask especially now at the beginning of the school year in Alachua County. Here is the information on rules regarding stopping for school buses:

- You should always stop for a school bus with its lights flashing; except if you are driving on a divided highway in the opposite direction of a bus and there is at least five feet of unpaved space, a raised median, or a physical barrier (concrete abutment) separating the roadway on which you are travelling from the roadway where a bus stopped. Only then you can continue to drive at a legal speed, but should still drive with an increased awareness that children might be around.

- In all other situations, you must stop when you see a school bus that has its stop lights blinking and stop signs showing, regardless of whether you are behind a bus or facing a bus, driving in the opposite direction.

Yes it is legal for a child under 16 to operate a ATV, but only on private or unpaved public land where the speed limit is less than 35 mph and only if certain requirements are met.

Those under 16.

- Must be directly supervised by a licensed driver; and

- Must wear a safety helmet, over-the-ankle boots and eye protection.

In addition, if they want to operate an ATV or a go-kart on public land, they must pass an approved off-highway vehicle safety course in Florida or another state. A nonresident of Florida who is under 16 and who is in Florida temporarily for less than 30 days is exempt from the safety course requirement.

In Florida, you may operate an ATV or go-kart only on private land or on unpaved public roadways where the speed limit is less than 35 mph. If you decide to operate an ATV or a go-kart on an unpaved public roadway, you can do so only during daytime. You are also prohibited from carrying a passenger, unless you are operating a two-rider ATV, specifically manufactured for two people.

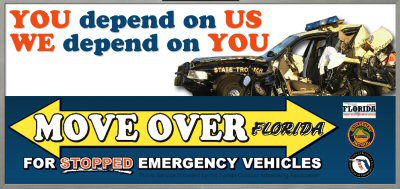

YES, that is correct! It is called Florida’s Move Over Law, which was enacted in 2002, for the purpose of protecting first responders while performing their jobs.

The law includes tow-trucks, patrol cars, and any emergency vehicle stopped on the side of the road with its lights flashing.

Here is what you need to know if you see lights flashing ahead:

- On a two-lane road, you are required to slow down 20 mph under the posted speed limit.

- If the speed limit is 20 mph, you are required to slow to 5 mph.

- On an interstate or a multiple lane road-way, you must move over a lane if safe to do so, or slow to 20 mph under the speed limit.

Violation of the Move Over Law can result in:

- Putting yourself, passengers, and emergency personnel at serious risk.

- Fines of around $150 and points on your driver’s license.

This is a very important question as driving drowsy, (not fully awake), is as dangerous as driving drunk and has been found by the National Highway Traffic Safety Administration to be the cause of 100,000 crashes each year.

Here is a typical scenario of an accident caused by driving drowsy:

- Crash occurs late at night/early morning or mid-afternoon (between midnight and 6 am. and between 1 pm and 5 pm)

- It is a serious accident

- A single vehicle leaves the roadway

- Often on high-speed roads

- There is no attempt to avoid the crash

- The driver is alone in the vehicle

- Young male driver age 16 to 29

Here are the best things to do to prevent this happening to you:

- Drive when alert and rested, after getting a good night’s sleep.

- Avoid alcohol especially when tired – it is a dangerous mix for driving.

- Avoid driving between midnight and 6 in the morning and beware of the afternoon slump between 1 and 5.

- If you get drowsy and heavy headed, pull over and take a power nap for 20 minutes, or switch drivers.

- Have someone keep the driver company while driving during the peak drowsy times of the day.

- Take breaks every hour or two and stretch your legs.

- Avoid driving long hours in one day, especially if alone.

This is an important question, and as an accident attorney, I suggest you check your vehicle’s maximum load capacity today, to find out how much it can safely hold. Most vehicles post the maximum load capacity limit in one of the front door jambs. If it is not listed there, look in your vehicle’s manual. The load capacity includes the driver, passengers and all cargo.

Many people are surprised to learn how easy it is to overload their vehicle with people, cargo, and pets, without knowing it. This is a safety issue that puts all in the car and on the road at risk, as an overloaded vehicle is an accident waiting to happen. Operating a vehicle that is overloaded is dangerous because it is less stable, takes longer to stop and causes the tires to overheat. Overloading a vehicle makes it prone to tire blowouts, roll over accidents, rear end crashes and other serious accidents.

Be safe and make sure you are not overloading your car – Check your vehicle’s load capacity today!

There have been some recent changes in Florida case law pertaining to Personal Injury Protection (PIP) insurance. Since 1972, insurance companies were required to have their doctor hold an independent medical evaluation to determine if the injured person required medical care. These “examinations” generally resulted in the termination of benefits. Now, the insurance doctor does not even have to physically examine the policy holder, they just have to review their medical records to legally state that the person does not need medical care.

Knowledgeable accident attorneys (personal injury attorneys) can assist their clients in getting their PIP benefits reinstated, if it is caused by insurance fraud, and make the insurance company pay for attorney fees and costs.

Here are my suggestions on what to do:

- If you get a letter from your insurance company either setting an insurance medical exam or cutting off benefits based on a “paper review” of your medical records, act immediately. Call an experienced accident attorney for advice. If you don’t you will lose your right to appeal the insurance company’s decision.

- It is important to hire an attorney who has handled PIP scam cases before and is up to date on the latest strategies to win your case.

- Continue to get medical treatment if you are seriously injured and the at-fault party has Bodily Injury Liability coverage or you have Uninsured Motorist coverage. This is important not only for your physical recovery, but for your personal injury case – having gaps in your medical treatment will hurt your case.

This is a very good question and one that is extremely relevant to everyone’s safety on the road in this day and age!

Inattention blindness is a term coined by two researchers in the 90’s that is used to describe the phenomena when people do not see objects that are right in front of them, in plain sight, their mind is unable to register them. It is sometimes called perceptual blindness. It has been proven by many studies that humans only have a limited capacity to pay attention to all details in their visual field when their mind is focused on something else; even when they think they are fully paying attention to the details. Please see the below links for some examples. You may be surprised to know that illusionists have taken advantage of this human characteristic for many years.

Yes, inattention blindness can be dangerous for pedestrians, bikers, cyclists, and drivers alike, especially when everyday 21st century gadgets such as cell phones, MP3 players, etc, are involved. These distractions preoccupy people’s minds and they mentally cannot register what they see. Many do not realize how much easier they can wander off course if distracted-whether on the road, in a bike lane, or on a sidewalk.

As a personal injury attorney, my suggestion is, if you are going to multitask, avoid doing it while driving or while walking on a busy street. Do not put yourself nor another driver or pedestrian at risk! That “gorilla on the court” could be an important piece of information required for everyone on or near the road to get home safely.

You are not alone if you have questions about what insurance Florida requires. Here, our founder, Jeffrey Meldon, shares his wisdom on why sufficient insurance is of utmost importance if you are involved in a serious accident with injuries – no matter who causes the crash.

Whether Bodily Injury Liability (BI) coverage is required or not has two main areas of law to consider.

- Bodily Injury Liability coverage is not required to drive an automobile in Florida legally. However, it can be if you have been convicted of a DUI. Under Florida Statue 324.023, Financial responsibility for bodily injury or death, you must have bodily injury insurance if you are convicted of a DUI. If you were convicted on or before October 1, 2007, the minimum requirement is $10,000 per person and $20,000 per incident. If you were convicted after October 1, 2007, the minimum required is $100,000 per person and $300,000 per accident. According to the Statute, you must have BI coverage for 3 years after the return of your driving privileges.

- Suppose you choose to drive without BI coverage. In that case, it is important to know that Florida has a Florida Financial Responsibility Law, which requires that a person who is at fault for an accident must provide financial coverage of at least $10,000 per person and $20,000 per accident. This means that if you cause an accident that results in bodily injuries to another person(s), you must either have BI insurance or post a bond for the required amount of coverage. If this “responsibility” is unmet, you can lose your driving privileges. You will also be required to make financial arrangements to pay for any judgment against you for property damage and bodily injuries before you can get your driver’s license reinstated.

As an accident attorney who has seen the devastation caused by inadequate insurance coverage, I not only advise that you have bodily injury liability but that you have more than the minimum to protect yourself and your assets fully. Specifically, I recommend a minimum of $100,000 per person and $300,000 per accident.

According to the National Highway Traffic Safety Administration, NHTSA, a majority of drivers consider unsafe drivers a major threat to public safely. Aggressive drivers likely contribute to more than 6 million crashes every year and 27,000 traffic fatalities.

So, what should you do when faced with an aggressive driver, who is driving under the influence of “impaired emotions?”

- Get out of their way. Change lanes, pull over, or let them pass.

- Don’t challenge them. Put your pride in check, and let them by.

- Ignore them. Don’t make eye contact and ignore obscene or threatening gestures.

- Call 911. Report an aggressive driver to Law Enforcement.

- Pay attention to the road, and wear your seat belt. Aggressive drivers may cause a wreck or disrupt the flow of traffic, so be prepared for the unexpected.

Aggressive driving means driving under the influence of “impaired emotions.” While aggressive driving is responsible for 27,000 traffic-related deaths each year, it is a lifestyle choice. So, people can choose to change.

The following questions may help you identify if you’re an aggressive driver. When you’re on the road, do you:

- Express frustration. Do you take your frustration, anger, or anxiety out on other drivers, passengers, or pedestrians? Do you make obscene hand gestures, scream, or make threatening facial expressions? Honk your horn, flash your lights, or rev your engine?

- Speed. Do you often receive speeding citations? Do you travel 15 mph over the speed limit? Drive as fast as you feel like? Do you “gun it” and slam on the brakes? Do you race other cars?

- Passengers refuse rides. Do passengers tell you they feel scared?

- Make frequent lane changes. Do you weave in and out of traffic to pass cars? Make frequent lane changes? Pass on the right or in the grass?

- Fail to obey traffic devices. Do you run red lights? Do you go through stop signs? Fail to stop for pedestrians or yield to traffic?

- Feel angry and stressed. Do you feel anger, frustration, aggression, anxiety, stress, rushed, or in a hurry?

- Tailgate.

- Feel lack of concern for other drivers.

If you answered yes to any of these questions, you may be an aggressive driver. What should you do?

- Relax. Slow down and use breathing techniques.

- Listen to calming music.

- Drive the posted speed limit.

- Avoid high traffic areas.

- Leave early and give yourself extra time.

- Decide to be late. Just be late, if all else fails.

- Use public transportation or ride with another driver.

- Attend an aggressive driving course.

This is good question and one we often need reminding of. First of all it is important to define what an emergency vehicle is. An easy way to remember this is to consider any vehicle flashing red, blue, or amber lights an emergency vehicle, whether it is a police vehicle, ambulance, fire truck, or even a tow truck.

With that understood, here is what to do when an emergency vehicle approaches you on the road with its “lights” on, siren or no siren.

If it is coming behind you, in your lane of traffic, you should pull over as soon as it is safe, to the side of the road or nearest clear, safe space. If it is approaching from the opposite lane, be prepared to slow or stop if the vehicle needs space to move into your lane. Remember, seconds count in an emergency situation and any delay could be deadly to the person requiring aid.

In addition, if you approach an emergency vehicle stopped on the side of the road in your lane of traffic in Florida, there is the Move Over Act. This law mandates you to move over or slow to 20 mph below the speed limit, if changing lanes is not safe.

Another reminder, most states have laws prohibiting any vehicle from following within 500 feet of an emergency vehicle.

As an experienced automobile attorney, I’m glad you asked this because the answer is-not behind the wheel. Experts agree that it’s safer to ride as a passenger than to drive while pregnant. If you have the choice, ride as a passenger in the back seat. In tests with “pregnant” crash test dummies, uterine strain was lower for vehicle occupants riding in the passenger position-mainly because there’s no steering wheel to hit. In a crash, contact with the wheel can be deadly for baby, so avoid driving if possible. When practical, ride in the passenger seat with a 3-point seat belt and airbag with the seat positioned as far rearward as possible.

For more information:

- 6 Steps of Buckling up with a Belly – Seat Belt Safety for Pregnant Women

- Is it safe to drive while I’m pregnant?

- Why is driving or riding in a car while I’m pregnant so dangerous?

As an experienced local personal injury attorney, I’ve seen the tragic results of failing to buckle up. As a reminder, car crashes are the leading cause of death for pregnant women and their fetuses. Having said that, there are ways to make driving safer when pregnant-wear a 3-point seat belt and keep the air bags activated. In tests with “pregnant” crash test dummies, unrestrained drivers sustained substantially greater abdominal and head trauma compared to fully restrained drivers. If you are in a crash, call a doctor right away, even if you feel fine immediately after the wreck.

For more information:

- Where is the safest place to ride in a car while I’m pregnant?

- Why is driving or riding in a car while I’m pregnant so dangerous?

- 6 Steps of Buckling up with a Belly – Seat Belt Safety for Pregnant Women

As a Gainesville accident attorney I can tell you that this is a very good question for Floridians. With our rainy weather conditions hydroplaning can easily happen resulting in serious accidents such as the recent accident on I-75 that caused a 14 car-pile up and closed the Interstate for 6 hours.

Viscous hydroplaning happens when a car’s tires lose traction, causing the vehicle to slide on a mixture of road oil, dust, and water. While “viscous hydroplaning” doesn’t necessarily involve deep, pooled water, it can cause sliding and loss of control over the vehicle. The danger for viscous hydroplaning is highest at the beginning of a storm, when oil and water mix on the road.

Florida, as a “retirement haven,” has lots of senior drivers on its roads. As an experienced Ocala Florida car accident attorney, I’d like to highlight the little-known risk of age and “drugged driving.”

Although older drivers are involved in fewer total car crashes, the number of drivers 65 years plus is expected to double by 2030. This means even more senior drivers in the sunshine state.

Older people are extremely susceptible to prescription and “over the counter” drug side effects because they often use multiple medications, according to a 2009 AAA Foundation for Traffic Safety study.

The study found that more than 71% of seniors reported using one or more prescription medications, and 68.7% used one or more potentially driver-impairing drugs.

Medications commonly used by senior drivers include anti-arthritics, muscle relaxants, analgesics (NSAIDS), anti-depressants, anti-anxiety agents, beta blockers, and anticonvulsants.

My advice-consult with your doctor and pharmacist before taking the wheel.

Being the victim of any traffic accident is traumatic. However, when the person causing the crash leaves the scene of the accident and does not stop to render aid or take responsibility, not only could you be seriously injured but extremely angry as well.

As a local accident attorney, serving Gainesville, Ocala and the entire state of Florida, here are 6 tips to help you know what to do if you are the victim of a hit and run accident:

- You have a duty to remain at the scene of the crash and render aid and provide information, if possible.

- Call 911 immediately. If you have any identifying information regarding the vehicle or driver that left the scene, give it to the police immediately over the phone.

- It is critical to get names and contact information for all witnesses. In a hit and run accident, witnesses are vitally important.

- Being a victim of a hit and run accident is much like being the victim of other accidents regarding your auto insurance policy. The exception being, you have to prove it was a hit and run and that the other person was at-fault.

- Your Uninsured Motorist Coverage will protect you in the event of a hit and run crash, whether you are in a motorist or a pedestrian, and the accident was not your fault.

- Anytime there are serious injuries resulting from an accident, it is best to get the advice and assistance of an experienced accident attorney.

While Florida law respects a rider’s choice to “ride free” of a helmet, I urge motorcyclists and passengers to wear state-approved safety helmets. The only scenario requiring insurance arises when a 21-year-old or older rider chooses to bike without a helmet. Florida law states that if a rider 21 years of age or older operates a bike without a helmet, then the motorcyclist must carry an insurance policy, providing at least $10,000 in medical benefits for injuries incurred as a result of a motorcycle crash. (See., Florida Statutes §316.011(2010)).

Traffic accidents involving motorcycles can easily be catastrophic and fatal. Remember, a majority of Florida motorists are uninsured, underinsured, or carry only minimum limits required by law-hardly enough to cover an emergency room trip. Motorcyclists are no exception-ride legally, safely, and responsibly-carry adequate insurance coverage, especially Uninsured Motorist Coverage.